APPENDIX 1

Partial Derivative of the Price with Respect to the Yield

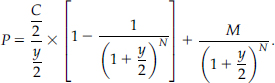

From the bond-pricing equation, we know that

The derivative of the second term with respect to the yield is

which is obviously negative.

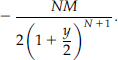

We will now demonstrate that the derivative of the first term is also negative by considering the present value of an annuity that pays $A per period.

We need to show that the term in the bracket is positive or, in other words, that

![]()

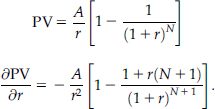

From the expression for a Maclaurin series, we know that

![]()

Thus, it is indeed the case that

![]()

Hence, the partial derivative of the present value of the annuity with respect to the discount rate is negative. Because the bond price consists of an annuity and a terminal cash flow, the derivative of whose present value has already been shown to be negative, we conclude that the partial derivative of the price of a plain vanilla bond with respect to the YTM is negative. ...

Get Fundamentals of Financial Instruments: An Introduction to Stocks, Bonds, Foreign Exchange, and Derivatives now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.