CHAPTER 12

Fundamental Analysis Summary

In prior chapters, we looked at various fundamental factors to select stocks as value investments. In this chapter, I rank the results. This provides an easy way to value a potential investment based on the discoveries discussed in this book.

PERFORMANCE RANK: ONE-YEAR HOLD

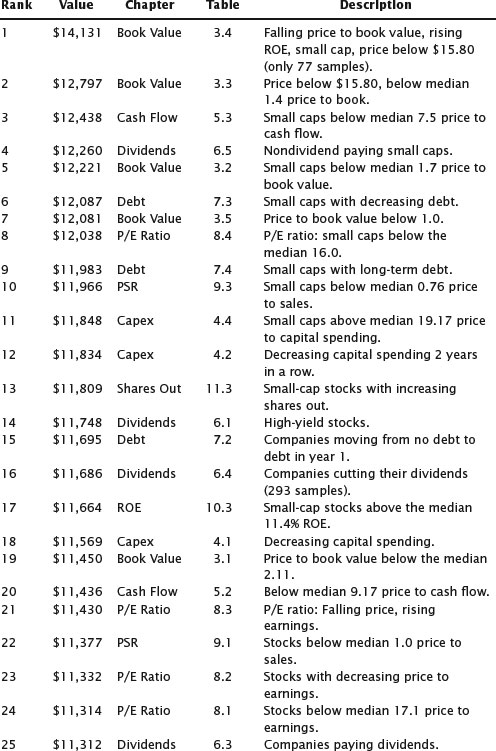

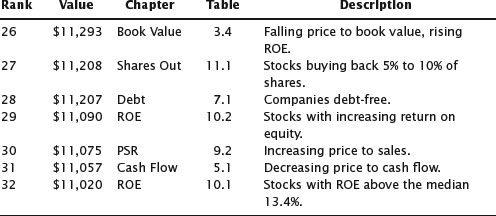

Table 12.1 shows a summary of the results detailed in the associated chapter table. Be careful about depending on anything that has a small sample size.

Table 12.1 Gain for One-Year Hold Time

For example, it is doubtful that the average small-cap stock priced below $15.80 with a falling price to book value and rising return on equity will return 41 percent after one year. That is the first entry in the table and it assumes a $10,000 investment. However, only 77 trades qualify, which is few compared to the thousands of trades that some other items use.

Comparing the second-place rank (which is more reliable than first place) with the last place, we see that the difference of a $10,000 investment is $1,777, or 18 percent. It might be worth an experiment where you select stocks with a variety of fundamental factors. Pick one with a low price to book value. Another might have a low price to cash flow, and so on, to achieve diversity among the fundamental factors. Of course, ...

Get Fundamental Analysis and Position Trading: Evolution of a Trader now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.