CHAPTER 3

How Trades Are Executed and Confirmed

My objective in this chapter is to convey the protocols surrounding the execution and confirmation of foreign exchange trades. We start with a look at the size of the foreign exchange market organized by the type of trade. The balance of the chapter is organized around some basic foreign exchange transactions.

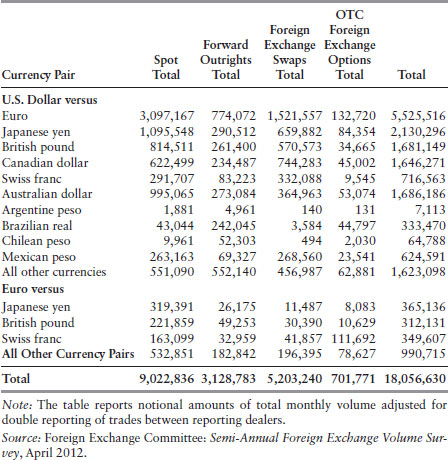

The Foreign Exchange Committee surveyed the North American foreign exchange market1 in April 2012 (Exhibit 3.1). The data are for the entire month of April (as opposed to the BIS data in Chapter 1, which are for a single day in a given month). The data show that trading—in all forms—is massively concentrated in the dollar against the euro, Japanese yen, Australian dollar, pound sterling, Canadian dollar, Swiss franc, and Mexican peso.

Exhibit 3.1 Total Monthly Volume of Foreign Exchange Transactions in North America

There is also significant, but less, trading in the euro against the yen, pound sterling, and Swiss franc.

Foreign exchange trading in all forms requires participation of a market-making dealer. Technically speaking, a dealer is anyone who acts as a principal in a transaction. Dealers trade with other dealers, of course, but for brevity I will refer only to the party who makes a quotation as the dealer. The other party, who is seeking to do a trade, is called the aggressor. The aggressor may approach one or more ...

Get Foreign Exchange Operations: Master Trading Agreements, Settlement, and Collateral now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.