EXAMPLES OF DRAG SETTINGS

In the following trade examples, all three time frames are represented. The first example shows the 60-minute drag used in the trade management of FLIR (Figures 10.4 and 10.5), a long trade in the spring market season (briefly shown in Figures 8.8 and 8.9). The other two illustrations exemplify the shorter time frames that were called for by the market seasons during which they were traded.

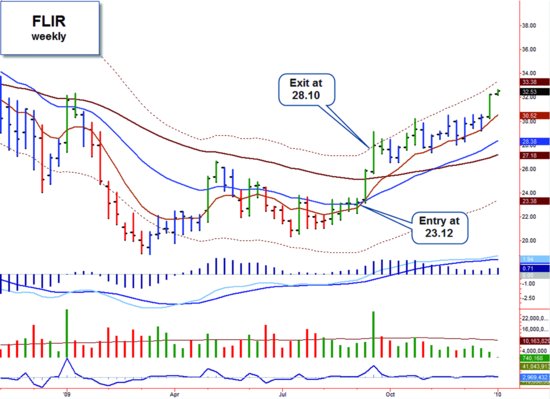

FIGURE 10.4 Catch and release.

FLIR, weekly, indicator set #20. FLIR trade displaying the entry and exit points, using a Strike Indicator and Drag System.

FIGURE 10.5 60-minute Drag System.

FLIR, 60-minute, indicator set #15. In Figure 10.5, entry is at 23.12. The stock immediately broke resistance, and the 60-minute Drag System was employed. • Bearish MACD crossover (area A). • Close below the 8-bar EMA (bar B). • Exit on the next bar at 28.09 (C). This Drag Setting maximized profit, gaining a whopping 21.5 percent over an eight-day period.

The next example outlines a trade where I used a 30-minute Drag Setting to manage the profit exit (Figures 10.6 and 10.7).

FIGURE 10.6 Netsuite trade using the Strike Indicator and the 30-minute Drag System.

N, daily, indicator set #8. In Figure 10.6, N trade shows the entry and exit points, using a Strike Indicator ...

Get Fly Fishing the Stock Market: How to Search for, Catch, and Net the Market's Best Trades now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.