VOLUME

The importance of volume in technical analysis is second only to that of prices. Volume is valuable in its raw form, but it is even more so when you convert volume into the Force Index, which we will review later in this chapter in the section on computerized indicators.

Volume level of any price move reflects the power of that move and the degree of conviction among traders (see Figure 2.19). Keep in mind that changes of volume are more important than the absolute levels. When prices break out above resistance or fall below support, the change of volume helps confirm a breakout or question its validity.

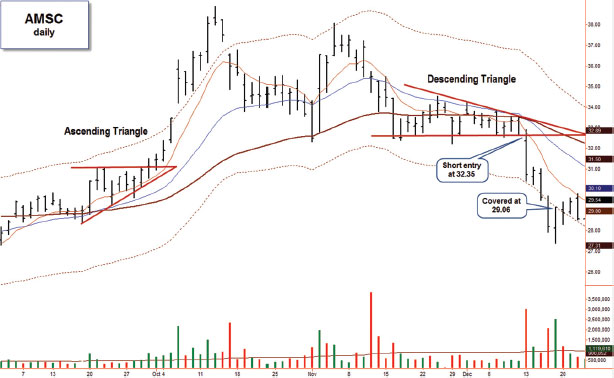

FIGURE 2.18 Arrows to the future.

AMSC, daily, indicator set #1. Ascending and descending triangles are like arrow points that indicate the likely direction of future price breaks. Ascending triangles tend to break out to the upside, and descending triangles usually break out to the downside. In my own trading, I missed the ascending triangle trade on this chart but caught the descending triangle. We have already looked at this trade in Figure 2.6, shorting the break of the lower border of the descending triangle.

FIGURE 2.19 The interaction of volume and price.

AMSC, daily, indicator set #1. As you track the downtrend of AMSC, the changes of volume either confirm the trend or tell you it is in trouble. Notice the increase or decrease in volume as price interacts with ...

Get Fly Fishing the Stock Market: How to Search for, Catch, and Net the Market's Best Trades now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.