Chapter 7

The Science of Term Structure Models

This chapter uses a very simple setting to show how to price interest rate contingent claims relative to a set of underlying securities by arbitrage arguments. Unlike the arbitrage pricing of securities with fixed cash flows in Part One, the techniques of this chapter require strong assumptions about how interest rates evolve in the future. This chapter also introduces option-adjusted spread (OAS) as the most popular measure of deviations of market prices from those predicted by models.

RATE AND PRICE TREES

Assume that the six-month and one-year spot rates are 5% and 5.15% respectively. Taking these market rates as given is equivalent to taking the prices of a six-month bond and a one-year bond as given. Securities with assumed prices are called underlying securities to distinguish them from the contingent claims priced by arbitrage arguments.

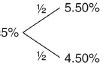

Next, assume that six months from now the six-month rate will be either 4.50% or 5.50% with equal probability. This very strong assumption is depicted by means of a binomial tree, where “binomial” means that only two future values are possible:

Note that the columns in the tree represent dates. The six-month rate is 5% today, which will be called date 0. On the next date six months from now, which will be called date 1, there are two possible outcomes or states of the world. The 5.50% state ...