CHAPTER 12

AMERICAN OPTIONS

Numerous interest rate securities have embedded American options, that is, the right of the option holder to receive a payoff of some kind any time before a predefined maturity. Some of these options are explicitly outlined within the terms of a contract, but others are somewhat hidden and are only embedded within another interest rate security. Let’s recall first the definition of an American option (see also Chapter 6).

Definition 12.1 An American call option is a contract between two counterparties in which one party (the option buyer) has the right, but not the obligation, to buy a given security at a predetermined price on or before a maturity time T, and the other party (the option seller) has the obligation to sell such security. An American put option is a similar contract in which the option buyer has the right to sell a given security at a predetermined price on or before a maturity time T, and the option seller has the obligation to purchase such security.

In this chapter we show that the tree methodology developed in Chapters 10 and 11 can be readily adapted to obtain pricing and hedging strategies for this more complicated security. We apply this methodology to classic American option securities, namely, callable bonds, American swaptions and mortgage backed securities.

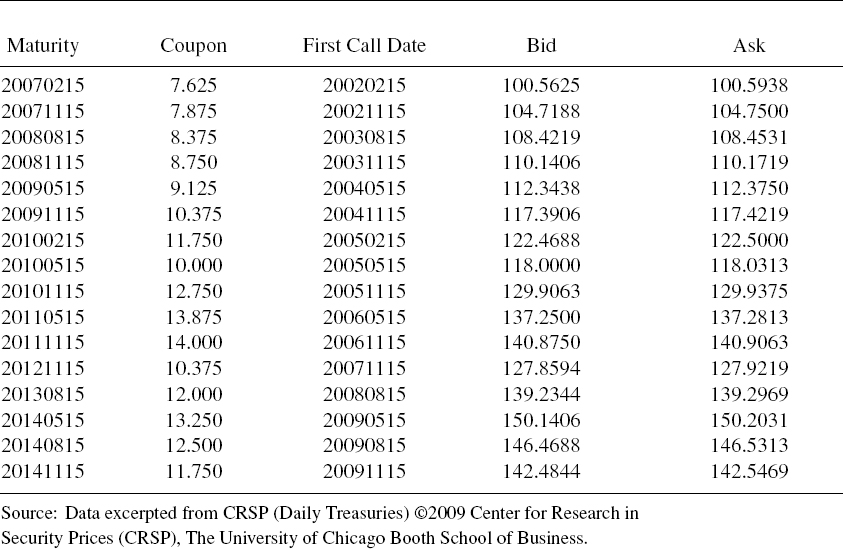

Table 12.1 U.S. Treasury Callable Bonds on January 8, 2002

12.1 CALLABLE ...

Get Fixed Income Securities: Valuation, Risk, and Risk Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.