CHAPTER 3

BASICS OF INTEREST RATE RISK MANAGEMENT

Interest rates change substantially over time, and their variation poses large risks to financial institutions, portfolio managers, corporations, governments, and, in fact, households. Anyone who directly or indirectly invests in fixed income securities or borrows money is subject to interest rate risks. This chapter discusses the basics of interest rate risk management. In particular, we discuss first how to measurxe risk for fixed income instruments, by introducing the notion of duration, value-at-risk and expected shortfall. Then, we also cover the basic techniques to mitigate financial risk, such as immunization and asset liability management.

3.1 THE VARIATION IN INTEREST RATES

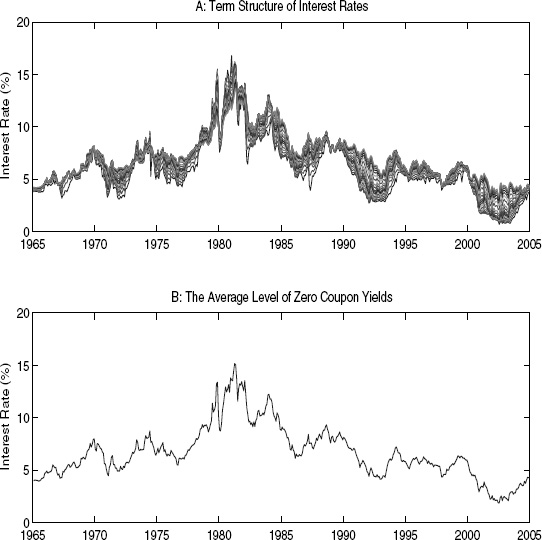

Interest rates change substantially over time. Panel A of Figure 3.1 plots the time series of yields from 1965 to 2005.1 The various lines, all very close to each other, are the continuously compounded yields of zero coupon bonds for maturities from 1 month to 10 years. The most immediate fact that springs out from Panel A of this figure is that all yields move up and down roughly together. For instance, they were all relatively low in the 1960s, they were all relatively high in the late 1970s and early 1980s, and they were all relatively low in the late 1990s.

Figure 3.1 Zero Coupon Bond Yields and the Level of Interest Rates: 1965 - 2005

Data Source: ...

Get Fixed Income Securities: Valuation, Risk, and Risk Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.