CHAPTER 21 Derivatives Risk Management: Convexity, Collateral, and Correlation

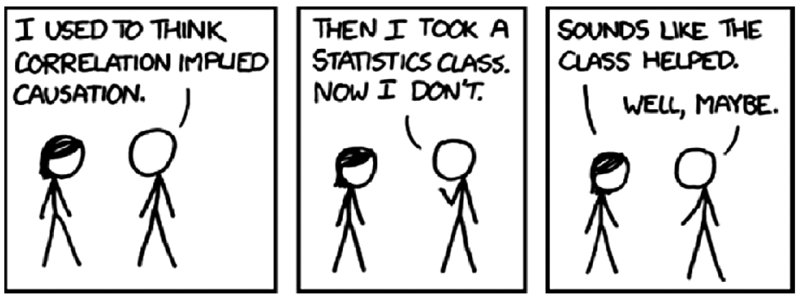

Source: http://xkcd.com/552/.

ABSTRACT

In this chapter, we introduce the concept of correlation and explain its relevance to finance. We start with a discussion of how it can be measured. We then move on to some simple products that allow us to trade the correlation and covariance. We explain how these factors lead to “convexity”, and how we can trade that. We then propose a method to bring all these ideas and prices together into a single consistent modelling framework. Finally, we discuss the relevance of these ideas to bond pricing.

WHY CORRELATION OCCURS IN THE MARKETS

Assets and other observable market instruments can be correlated for various reasons. We discuss the major causes of correlations below.

Macroeconomic Reasons

If economic conditions change, this is likely to impact many assets in the same way, due to their exposure to systematic risk (referred to as Beta in the Capital Asset Pricing Model). The more closely related two assets are, the higher their correlation is likely to be. For example, almost all stock prices will have some kind of positive correlation. Changes in the values of shares of companies that are in the same country or business area will be particularly highly correlated. This is because there will exist specific risks that affect these closely related ...

Get Fixed Income Markets: Management, Trading and Hedging, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.