CHAPTER 2

BANKS

The largest industry group in most Financials sector benchmarks globally is the Bank industry group. It includes both regional and diversified banks as well as Thrifts and Mortgage Finance companies. Since they all tend to act similarly and have similar characteristics, we’ll use the term bank to refer to firms in all of this group’s sub-industries.

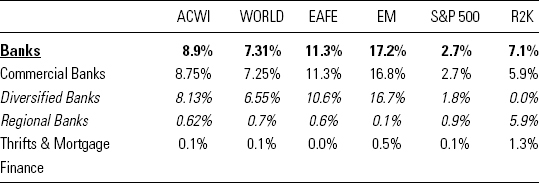

As Table 2.1 shows, Banks is a substantial weight in most broad equity benchmarks globally but only a small weight in the S&P 500. This is because despite having the largest domestic banks, “mega banks” like Bank of America, JP Morgan Chase & Co. and Citigroup are technically not in the Bank industry group. They’re considered Diversified Financials companies, and they are very diversified—arguably no single business line is dominant. The same is true in Germany, where Deutsche Bank is also considered a Diversified Financials company. If we add these “banks” back into the industry group, the US weighting looks more like foreign benchmarks at 5.0 %.1

Table 2.1 Bank Weighting Among Benchmarks

Source: Thomson Reuters; MSCI, Inc.,2 S&P 500, and Russell 2000 Indexes. As of 12/31/2011.

Banks, whatever their form, are the lifeblood of most economies—they facilitate the transfer and multiplication of money, payment systems, investment, leverage, etc. Beyond being a vital component of most economies and one of the largest industry ...

Get Fisher Investments on Financials now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.