STRUCTURED PRODUCTS AND CDOS

Now that we have covered the basics of simulating general asset price pools, we will move to default analysis, in particular the structured finance world. The term structured finance covers a wide range of financial products that have been created to transfer risk differently than do traditional equity and fixed income investments. In general, structured products are created for one of three reasons: to provide/supply leverage, to allow investors to minimize exposure to regulatory or taxation rules, or to allow access to a particular type of risk while minimizing idiosyncratic or company-specific risks like a company's bankruptcy.

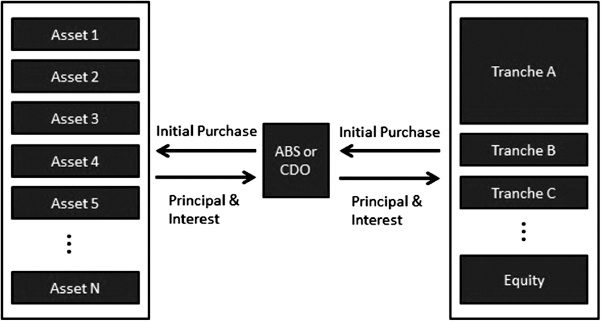

In the credit world, the most prominent classes of structured product are asset-backed securities. Asset-backed securities, or ABS, are debt and equity that are backed not by an operating company, but by a special-purpose entity whose sole assets are a portfolio of similar notes, such as trade receivables or auto loans (or in some cases the assets themselves, such as with airplanes).

FIGURE 6.7 A generalized structure of CDO and ABS. Principal and interest payments are made by the assets in the CDO, then distributed to the holders of difference tranches according to a “waterfall.”

One large set of structured products are collateralized debt obligations, or CDOs. CDOs, particularly ones that are backed by corporate loans, are ...

Get Financial Simulation Modeling in Excel now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.