TUNING THE MODEL—DATA SETS AND DRIFT

While the traditional Merton Model is fairly robust, certain assumptions in its application have major implications for the results. One key factor is μ, the expected return or “drift” of assets over time. Some practitioners set the drift term to equal zero on the theory that most assets used by an operating company need to be financed, so riskless returns associated with these assets go to note holders and do not impact the optionality of the equity. Other practitioners use the risk-free rate or the inflation rate. To our knowledge, as of 2010 there has not been a comprehensive study or analysis published on the role of drift in credit modeling. However, for longer-term analysis, the drift term can have a major impact on the results.

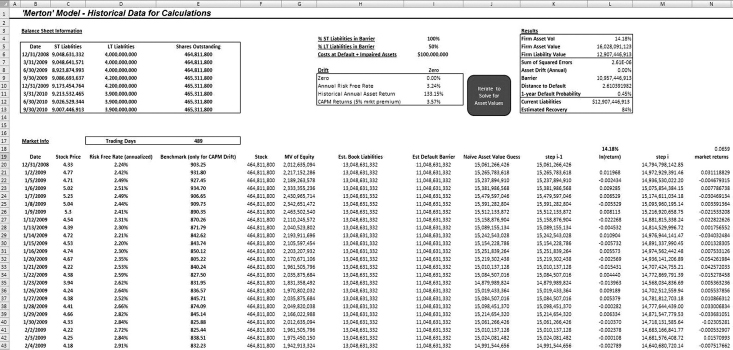

FIGURE 5.5 The completed Model Builder 5.5, with potential options for drift laid out in H9:I12. Note that the applied drift rate in L8 is 0.00 percent.

Perhaps more important to the results is how volatility is calculated. There is no widely accepted rule as to how equity volatility should be calculated. Different methods of gathering volatility data can result in substantially different estimations of default risk.

Volatility

In general, volatility will be the most important variable for determining the risk of a company, and as a result most of the work in tuning the model will be done with this variable. Admittedly, ...

Get Financial Simulation Modeling in Excel now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.