INSTRUCTIONAL METHODOLOGY

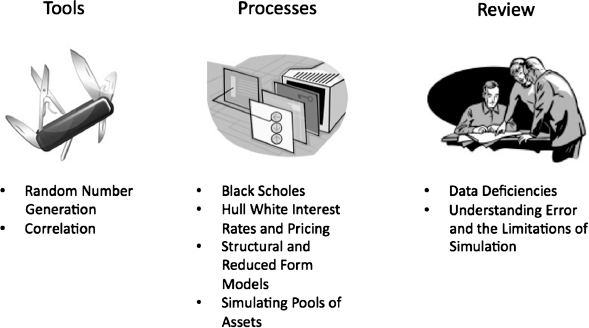

Financial simulation can be a tricky subject for readers and authors since people have a multitude of reasons for using simulation in finance. To approach this unique issue, the book is laid out in a specific manner. Chapters 2 and 3 are what I would call “tool set” chapters. They focus on core elements of simulations that are inherent to most financial simulations (and to many simulations in other fields as well). Chapter 2 works through random number generation and eventually to explaining a common term heard in finance, Brownian motion. After that, in Chapter 3, correlation between variables is explained with examples on how correlated random numbers are generated. These tools are invaluable for constructing simulations and require a thorough understanding. For instance, one of the most common errors I have noticed financial analysts make when implementing simulations for the first time is an incorrect method of generating random numbers. Similarly, incorrectly accounting for correlation can lead to massive problems in a simulation.

FIGURE 1.2 The chapters in this book follow a logical and intended order.

Once the tools are developed, readers begin to use them for different purposes. Chapter 4 takes readers through simulating interest rate paths to price bonds using methods credited to Hull and White. Chapter 5 expands the reader's knowledge of simulation ...

Get Financial Simulation Modeling in Excel now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.