CHAPTER 70 Estate Planning for Non-Traditional Relationships

Elissa Buie, MBA, CFP®

Golden Gate University

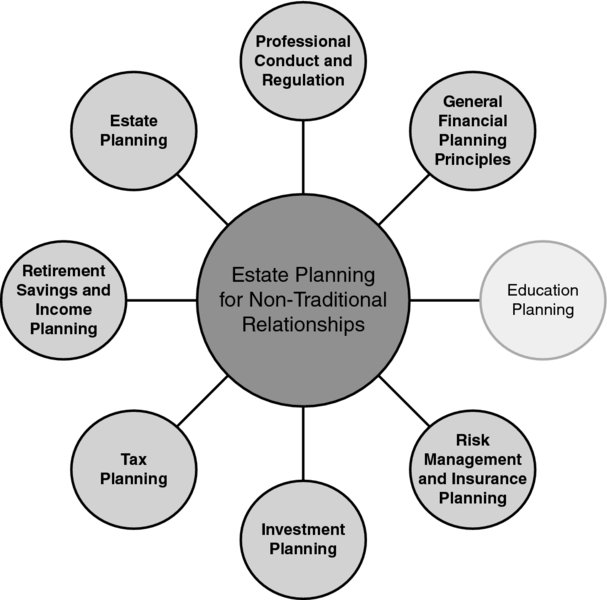

CONNECTIONS DIAGRAM

Estate planning (including gift planning) for non-traditional couples encompasses the entire financial planning process and its component parts. General principles of financial planning, including financial statements, cash flow management, and other concepts, are necessary. Insurance planning and risk management are critical estate planning components for non-traditional couples. Income tax planning is relevant, as is retirement planning. The ability to share assets, protect each other, plan for combined retirements, and consider other responsibilities (e.g., children from prior marriages or prior spouses) is often more complex. In addition to its inherent complexity, the discussion around issues relating to non-traditional couples may be sensitive. This necessitates excellent communication skills on the part of the financial planner. Also, any estate planning strategy requires working alongside other professionals, such as estate planning attorneys, tax accountants, or insurance agents. Good interpersonal communication will facilitate the work of the group of advisors for the benefit of the client. The planner must adhere to ethical standards of professional conduct and fiduciary responsibility.

INTRODUCTION

For the purposes of this chapter, a non-traditional ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.