CHAPTER 67 Marital Deduction

Elissa Buie, MBA, CFP®

Golden Gate University

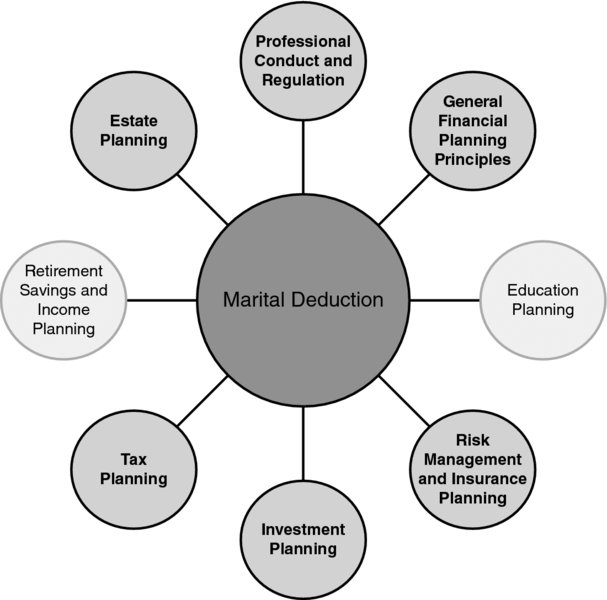

CONNECTIONS DIAGRAM

The marital deduction is a key aspect of estate planning. Its beneficial use and the tactics to be implemented (e.g., titling of assets) must be explained clearly, making interpersonal communication important. Gift, estate, and income tax laws will impact the analysis and strategy incorporated by a financial planner. How insurance and investments are incorporated into a client’s financial situation will impact the marital deduction. Also, as with every aspect of financial planning, the planner must adhere to standards of professional conduct and fiduciary responsibility.

INTRODUCTION

Assets gifted or left (at death) to a spouse are generally estate and gift tax free due to the unlimited marital deduction. That sometimes means that leaving all of one’s assets to a spouse is the easiest and most cost-effective estate plan. However, this is not always the case.

First, assets gifted or left to a non-U.S. spouse do not qualify for the unlimited marital deduction. (The solution to this dilemma is to establish a qualified domestic interest trust.) If the provisions of this trust comply with the Technical and Miscellaneous Revenue Act of 1988 (TAMRA), there will be no taxes due at the death of the first spouse (leaving assets to the non-U.S. spouse). Taxes will be due, based on the estate ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.