CHAPTER 65 Sources for Estate Liquidity

Elissa Buie, MBA, CFP®

Golden Gate University

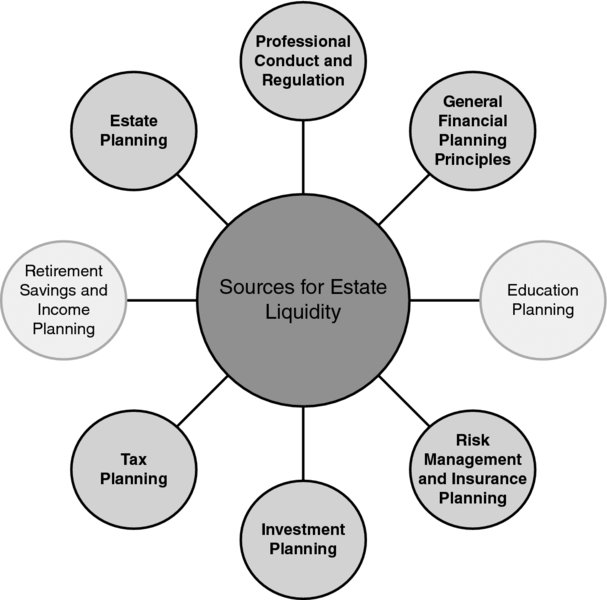

CONNECTIONS DIAGRAM

Analyzing sources of estate liquidity requires basic financial planning principles, such as creating and using financial statements. Insurance is a good source of estate liquidity in many circumstances. Consideration of which assets to use in which ways and how to plan for the financial needs of the heirs (e.g., carrying costs for a piece of real estate or a business) entail a thorough understanding of investments. Discussing sources of estate liquidity is not the most complex topic but still one that requires a lot of number crunching and, consequently, good interpersonal communication skills for dealing with the estate fiduciaries and beneficiaries. The analysis of estate liquidity is generally completed in coordination with other professionals such as estate planning attorneys, tax preparers, and insurance agents. Good interpersonal communication will facilitate the work of the group of advisers for the benefit of the client. And finally, as with every aspect of financial planning, the planner must adhere to standards of professional conduct and fiduciary responsibility.

INTRODUCTION

Estate liquidity is vital to financial stability of the estate. Lack of liquidity can result in negative outcomes (e.g., the inability to pay bills; to carry, sell, or distribute assets ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.