CHAPTER 64 Estate Tax Compliance and Tax Calculation

Elissa Buie, MBA, CFP®

Golden Gate University

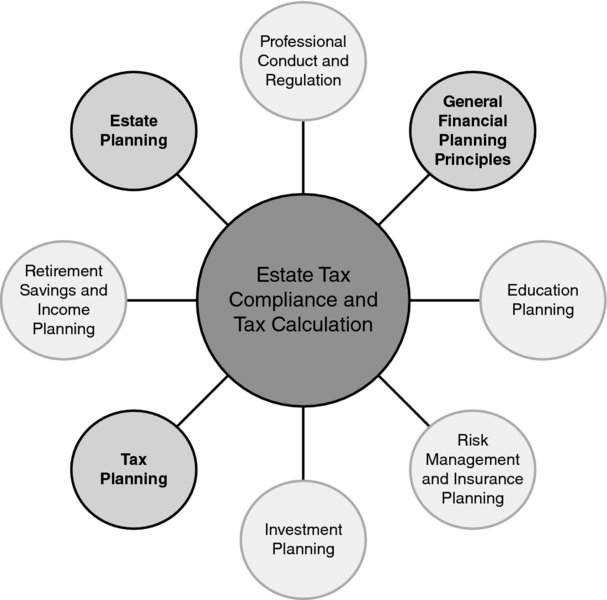

CONNECTIONS DIAGRAM

Estate tax compliance and calculation requires the services of a qualified estate planning attorney and tax preparer. A financial planner must also understand the Unified Gift and Estate Tax calculations, as well as the process for calculating the estate and resulting tax and the methods of reducing estate taxes. With recent changes in the Unified Gift and Estate Tax laws, income tax ramifications became more critical to the estate planning process. Financial planners must utilize their interpersonal communication skills to clearly explain issues to the clients and to work closely with the other professionals involved in the estate tax compliance and calculation process. Finally, as with every aspect of financial planning, the planner must adhere to standards of professional conduct and fiduciary responsibility.

INTRODUCTION

The United States has a Unified Gift and Estate Tax system. At death, everything a person owns is accounted for, valued, reduced for outstanding debts (including burial and estate settlement costs), reduced by allowable deductions, and adjusted for lifetime gifts. The resulting tax is calculated, and available credits are applied to result in the estate tax liability. As complex as these prior two sentences may sound, they sorely underestimate ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.