CHAPTER 60 Business Succession Planning

John E. Grable, PhD, CFP®

University of Georgia

Joseph W. Goetz, PhD

University of Georgia

Kevin Valentino, MS

University of Georgia

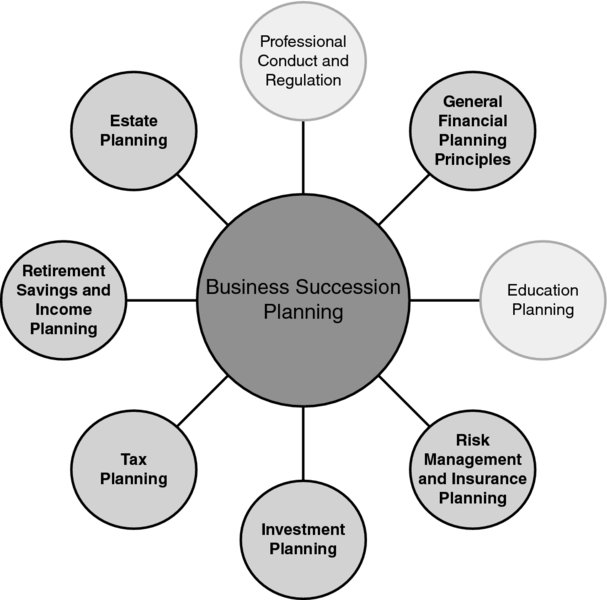

CONNECTIONS DIAGRAM

One of the most important questions asked by an owner of a family business is how he or she can pass on their business to family members or new owners at the owner’s death. This issue is both timely and important, as it is estimated that 80 to 90 percent of all business enterprises in North America are family-owned.1 Given that family businesses are generally privately owned companies that are not keen on sharing company information with outsiders, the question of business succession weighs heavily on many family business owners. It is quite common for business owners to reach out to financial planners for advice and counsel regarding whether family control of a business is a profit-maximizing business model.

It is estimated that over 70 percent of family-owned businesses do not survive the transition from first to second generation.2 Interestingly, however, approximately 66 percent of business owners prefer to keep their business in the family.3 With such a large percentage of American businesses family-owned, the question of whether to pass a business down to family members or an outside party is a question financial planners should be able to effectively address. The answer is not always ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.