CHAPTER 58 Distribution Rules and Taxation

Andrew Head, MA, CFP®

Western Kentucky University

Sharon A. Burns, PhD, CPA (Inactive)

CONNECTIONS DIAGRAM

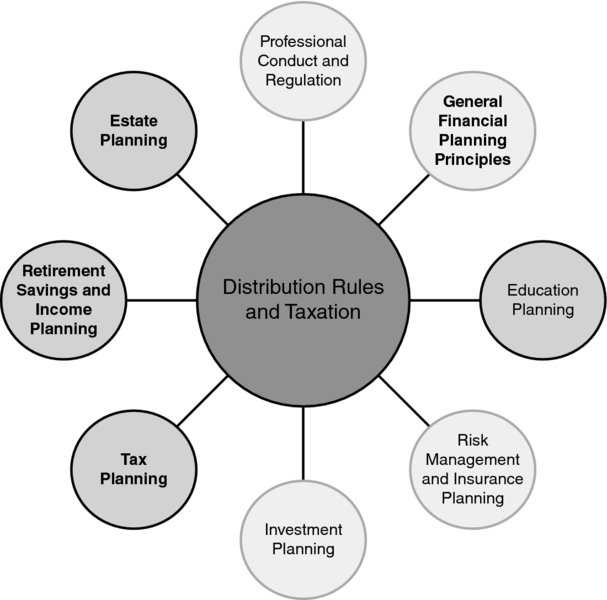

The financial planner must be aware of distribution rules and tax consequences associated with various types of investments and accounts. While this issue predominantly pertains to retirement planning, one must be aware of the rules for other content areas as well. Education planning is one of these areas, as there are specific requirements, discussed elsewhere in this book, that pertain to education savings accounts such as the 529 plan or Coverdell. The rules associated with both required and elective distributions from qualified retirement accounts have ramifications not only for the client’s tax bill, but for the retirement income plan as a whole. Finally, the impact that distribution rules and taxes have on legacy planning must not be ignored as a proper strategy can preserve wealth between generations.

INTRODUCTION

Social Security benefits provide a base income for nearly all retired U.S. workers. The program was not designed to provide a majority, much less all, of a retiree’s income. To provide workers the opportunity to maintain their standard of living into retirement, the U.S. Internal Revenue Code (IRC) and Department of Labor regulations allow employers and workers to defer some of a worker’s income from working ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.