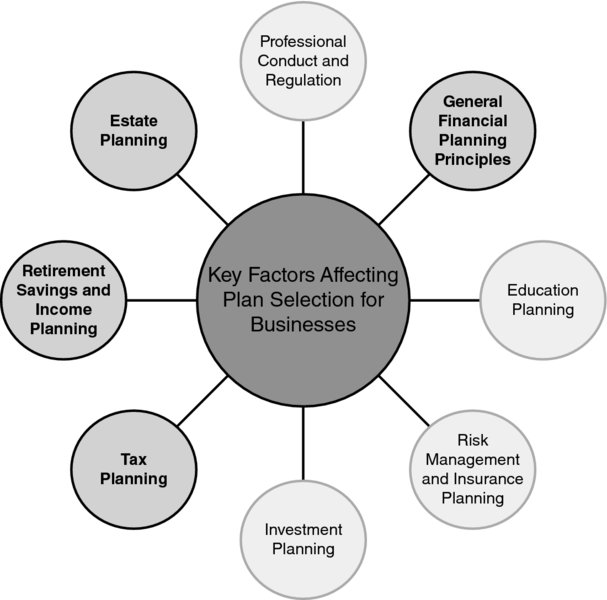

CHAPTER 57 Key Factors Affecting Plan Selection for Businesses

Andrew Head, MA, CFP®

Western Kentucky University

Sharon A. Burns, PhD, CPA (Inactive)

CONNECTIONS DIAGRAM

Retirement plans play an important role in the operations of a business. First, they serve as a piece of the total compensation package for employees and owners. Second, tax law allows deferral of income taxation on these benefits, which allows owners to maximize cash flow over a period of time beyond the earnings years. Finally, because retirement benefits may be passed to heirs using special rules, an understanding of the integration of retirement benefits with other assets is critical.

INTRODUCTION

Retirement plans are a key component of any business’s total compensation package. The purpose of a good benefit program is not only to attract and retain qualified employees, but to also maximize the return on the owners’ investment and work efforts in the business. An owner’s needs may include income shifting, income and estate tax minimization, and estate plan management. Selecting the appropriate retirement plan can fulfill many of a business owner’s financial planning needs.

Retirement plan benefits can be an expensive component of a business’s operations. The amount of cash available for funding benefits will be of great importance to owners.

The cost of a plan includes not only the contributions that must ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.