CHAPTER 56 Regulatory Considerations

Andrew Head, MA, CFP®

Western Kentucky University

Sharon A. Burns, PhD, CPA (Inactive)

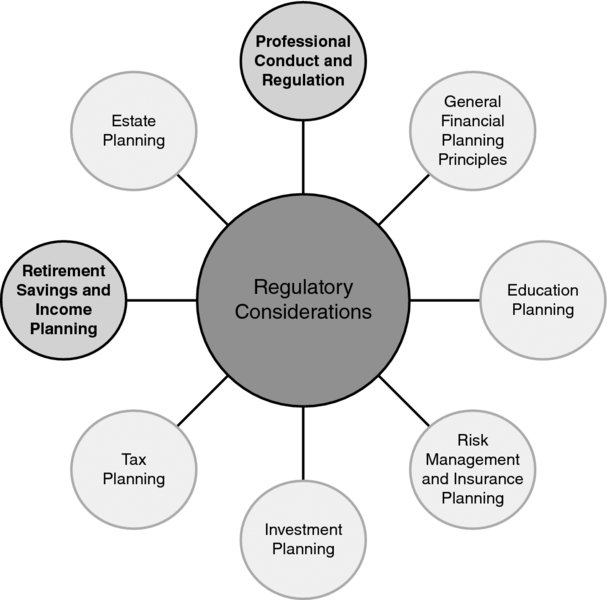

CONNECTIONS DIAGRAM

INTRODUCTION

Various government regulations and agencies require pension plan sponsors (employers) to protect workers’ retirement plan assets. Unfunded or underfunded pension plans place a large risk on the long-term financial stability and security of their participants. A bankrupt fund will require a plan participant to significantly alter his or her cash flow plans leading up to and during retirement.

Employers use retirement plans as one component of a compensation package to attract and retain good employees. Workers have come to rely on corporate plans to significantly increase their retirement income. One law and two government agencies are the primary sources of protection for these plans. The law that governs qualified pension plans is the Employee Retirement Income Security Act of 1974 (ERISA). The Department of Labor is responsible for regulating pension plans using the provisions of ERISA. In addition, a quasi-government agency, the Pension Benefit Guaranty Corporation (PBGC), provides insurance protection of plan assets.

There are several basic ERISA rules that every financial planner should know. They address issues of eligibility, funding, coverage, vesting, and termination. Because the rules are detailed and complex, ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.