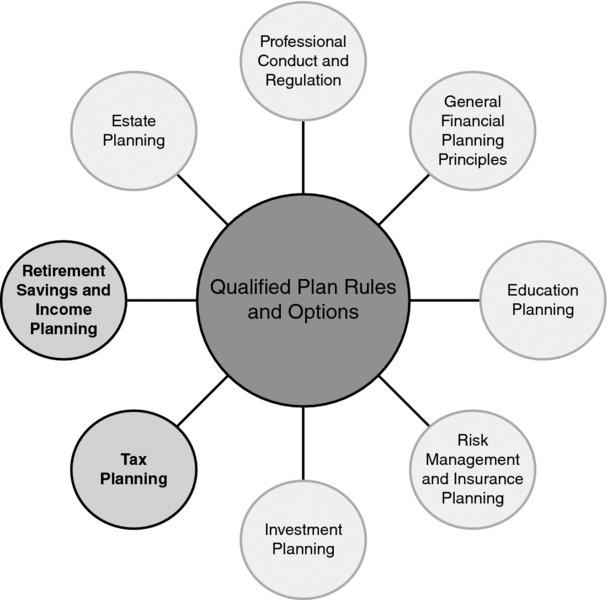

CHAPTER 54 Qualified Plan Rules and Options

Andrew Head, MA, CFP®

Western Kentucky University

Sharon A. Burns, PhD, CPA (Inactive)

CONNECTIONS DIAGRAM

A large and important component of an individual’s employment compensation is the retirement plan benefit offered by an employer. Although an employer’s contribution to a retirement plan is not available for current consumption, it will produce an income stream at retirement. This transfer of income from the current earnings period to a later period is a fundamental retirement planning event and allows clients to even out their cash flows over time. One must understand, however, the effect retirement benefits have on income taxes, now and in the future.

INTRODUCTION

Employers use retirement plans as one component of a compensation package to attract and retain good employees. Because of the principle of compounding, retirement plans allow employers to lower their cost of labor while enhancing the income of their employees.

A basic concept in income tax theory is that income is taxed during the period in which it is earned. In other words, if one earns a dollar today, one pays taxes on a dollar today. Tax theory also includes a matching concept—if income is taxed to one person, then the cost of providing the income is deductible to the payer in the same time period.

Qualified pension plan rules, however, violate both these concepts. ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.