CHAPTER 49 Charitable/Philanthropic Contributions and Deductions

Webster Hewitt, CPA, CFP®

University of Georgia

Lance Palmer, PhD, CPA, CFP®

University of Georgia

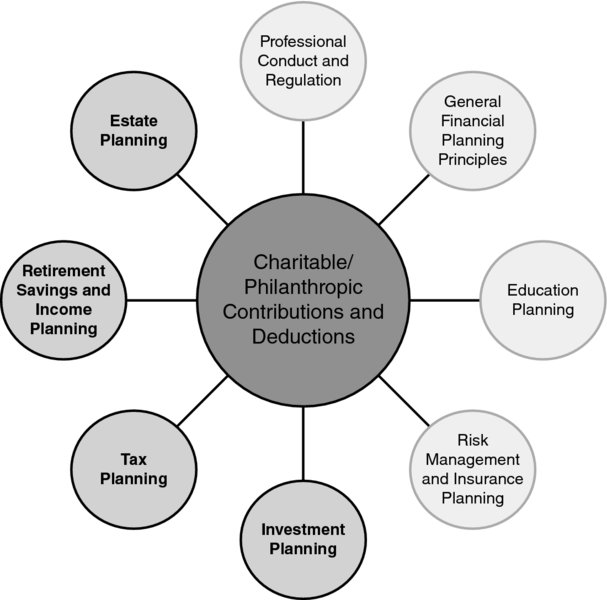

CONNECTIONS DIAGRAM

A comprehensive and integrated charitable giving plan for clients will require an understanding of the clients’ current and future income tax situations, their goals for the transfer of assets at their deaths, as well as an understanding of the nature of the property that they wish to give. Certain types of highly appreciated investment property provide personal financial planners with significant planning opportunities for those clients who have expressed philanthropic aspirations or are currently engaged in charitable giving.

INTRODUCTION

The United States has historically encouraged gifts to charity by allowing individuals and businesses to take tax deductions for contributions to such organizations. While Congress debates the future of income tax reform, including eliminating many itemized deductions or capping the amount of deductions for high-income taxpayers, it is likely that contributions to qualified charitable organizations will continue to be deductible for the foreseeable future, although adjustments to the current law are always possible. This chapter focuses on the current income tax rules at the individual level and identifies advantages and disadvantages of different assets. ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.