CHAPTER 48 Tax Implications of Special Circumstances

Lance Palmer, PhD, CPA, CFP®

University of Georgia

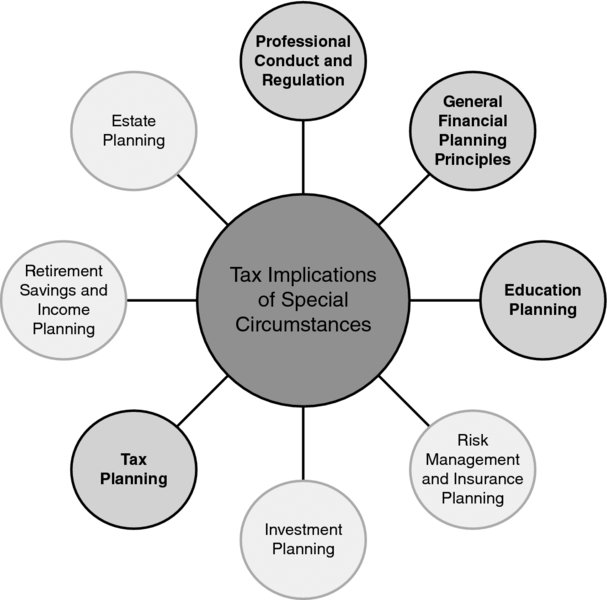

CONNECTIONS DIAGRAM

An individual client’s special tax situation may be related to a variety of different areas of financial planning. Most often, these situations relate to very important non-financial goals and objectives such as family and caregiving. These goals are particularly pronounced when a client is caring for an aging parent who is no longer able to live independently, or when an adult child is not able to live independently due to a physical or mental condition.

Sometimes these special tax circumstances are linked to family dissolution. Couples that have been married relatively long periods of time have likely accumulated many assets and liabilities over the course of their marriage, yet some of these assets may only be held in one spouse’s name, such as a retirement plan through a spouse’s employer. Divorce settlements may include the division of such assets between spouses, but financial planners need to understand how such transactions must be carried out in order to achieve the intended outcome. Because of the nature of these events, client communication is perhaps the most important content area to understand in relation to these situations. Estate planning, in relation to the client’s parents’ estate, is also an important consideration when providing care ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.