CHAPTER 47 Passive Activity and At-Risk Rules

Lance Palmer, PhD, CPA, CFP®

University of Georgia

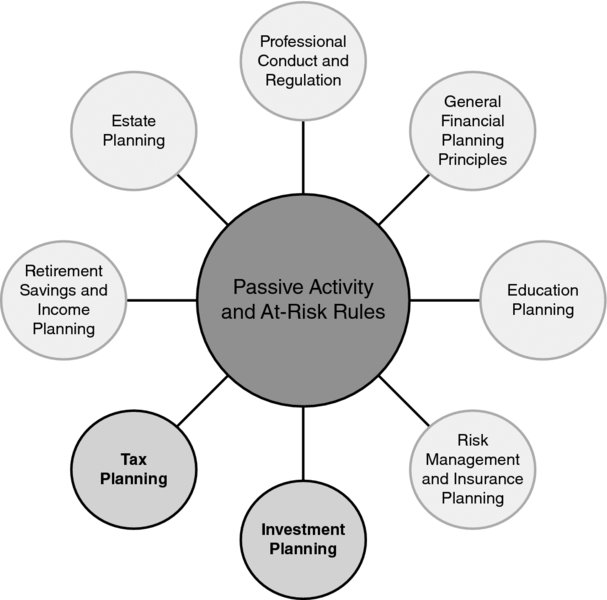

CONNECTIONS DIAGRAM

Planning relating to passive activity and at-risk rules should be conducted in conjunction with qualified CPAs or tax attorneys. A financial planner should take part in this planning process. Due to the focused nature of this topic, it generally only affects the income taxation of clients who choose to invest in various types of partnerships and limited liability companies and who do not participate directly in the routine management of the business. In situations like this, the investment may qualify as a passive activity, and financial planners should be aware of the income tax implications of that activity.

INTRODUCTION

Tax policy directly affects the economy. In some instances, effective tax policy may stimulate the economy, while in other instances tax policy may work against economic expansion. A good example of tax policy that worked against economic expansion was when investors sought unprofitable ventures over profitable ones due to the taxation of those ventures. Not too long ago, the Internal Revenue Code allowed investors in partnerships to take losses in excess of the amount of economic losses that an individual could accrue as a result of the investment. This led to an inefficient flow of capital in the country’s free market economy and capital ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.