CHAPTER 46 Tax Consequences of Property Transactions

Lance Palmer, PhD, CPA, CFP®

University of Georgia

Martin C. Seay, PhD, CFP®

Kansas State University

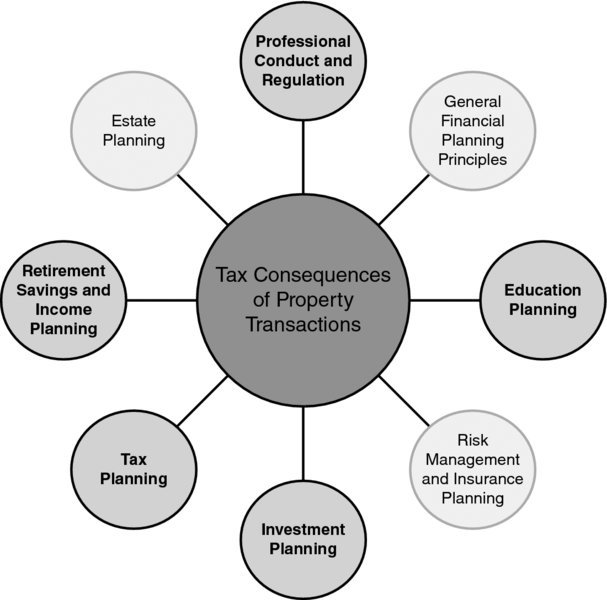

CONNECTIONS DIAGRAM

Overall, the tax consequences of property transactions can materially impact income taxes, investment planning, estate planning, retirement planning, education planning, and risk management and insurance planning. An understanding of the tax implications of property transactions is critical when making investment decisions. Similarly, retirement planning and education planning require personal financial planners to understand the tax consequences of property transactions when assets are held in standard investment accounts, as well as when they are held in tax advantaged accounts. In estate planning, the decision to sell property prior to death or retain it to bequest at the time of death can be partly motivated by current tax laws. Lastly, when property is involuntarily converted due to theft, damage, or full destruction, a portion of the insurance proceeds may be taxed under certain conditions.

INTRODUCTION

When property is sold, or converted into cash or other property by some other means, the taxpayer must calculate the gain or loss on the sale or conversion of the property. Selling price, or fair market value at the time of conversion, less the basis of the asset, less any selling costs equals the ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.