CHAPTER 45 Tax Reduction and Management Techniques

Lance Palmer, PhD, CPA, CFP®

University of Georgia

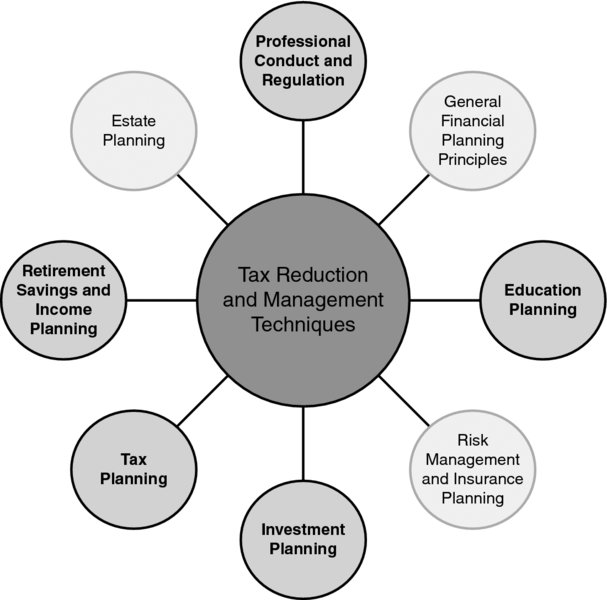

CONNECTIONS DIAGRAM

Congress, through the United States Internal Revenue Code (IRC), has implemented many social and economic policies through tax incentives or additional taxes. Given the underlying motivations of these incentives (i.e., social and other policy objectives), they are diverse and found throughout the IRC and can apply to many different areas of financial planning. These tax incentives often arise in retirement, investment, and education planning and can also be found in estate planning issues as well.

INTRODUCTION

The legal right of a taxpayer to decrease the amount of what otherwise would be his taxes, or altogether avoid them, by means which the law permits, cannot be doubted.

—U.S. Supreme Court, Gregory v. Helvering, 293 U.S. 465 (1935)

Embedded in the U.S. Internal Revenue Code (IRC) is a complex conglomeration of revenue, economic, and social policy measures. Congress has sought to incentivize, or reward, economically and socially desirable behaviors of taxpayers. Congress generally motivates such behavior by providing tax incentives in the form of permissible tax deductions or tax credits, or excluding some items from taxable income. As a result of these diverse policy goals being integrated into the tax code, meaningful opportunities exist for financial ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.