CHAPTER 44 Alternative Minimum Tax (AMT)

Webster Hewitt, CPA, CFP®

University of Georgia

Lance Palmer, PhD, CPA, CFP®

University of Georgia

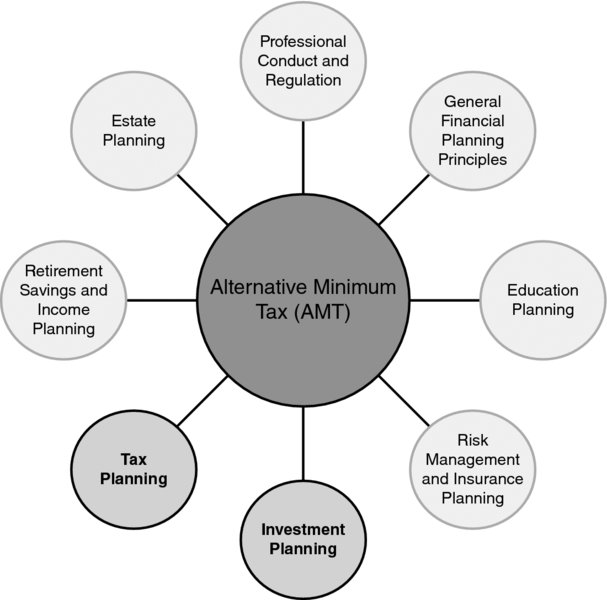

CONNECTIONS DIAGRAM

This chapter is primarily focused on taxation, but has some connection to investments and employee benefits (incentive stock options).

INTRODUCTION

Congress has exercised its legislative power in numerous instances and used the tax system to encourage taxpayers to engage in various transactions that it deems economically or socially desirable. The result of these incentives is tax relief for participation in these provisions. As the number of such relief provisions grew through the years, Congress became increasingly aware that many taxpayers were carefully planning their affairs to take maximum advantage of these opportunities. As a result, a large number of individuals and corporations with large economic incomes were paying little or no tax. Instead of trying to reduce these incentives, legislators decided to impose an additional tax on those taxpayers Congress believed were overly taking advantage of tax relief provisions. Congress first enacted a tax in 1969 that was in addition to the regular income tax liability and was focused on certain preferences. However, this was overhauled in 1978 by a separate, parallel tax system with an alternative calculation of an additional tax liability that results in a minimum ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.