CHAPTER 42 Characteristics and Income Taxation of Business Entities

Webster Hewitt, CPA, CFP®

University of Georgia

Lance Palmer, PhD, CPA, CFP®

University of Georgia

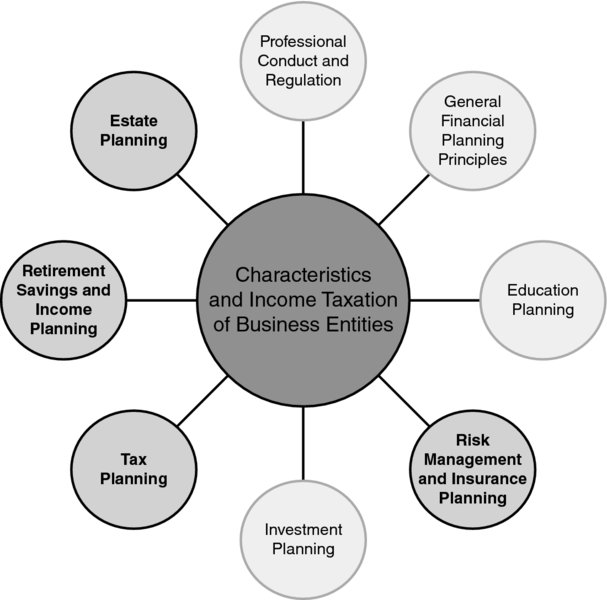

CONNECTIONS DIAGRAM

Business entity selection will directly affect the taxation of income associated with the business activity. However, equally important (if not more important) to the tax ramifications of this decision is the need to properly manage business-related risks and opportunities by selecting the most appropriate business entity form that will mitigate risks posed by the business activity. Estate planning objectives may also be very important considerations when selecting among types of business entities to house certain income-producing activities.

INTRODUCTION

This section is an introduction to the complexities and strategy behind business entity selection. The rules can be complex and may vary across individual states. Knowledge in this complex area is critically important to the personal financial planner, as self-employment (SE) continues to gain in popularity, including from within our own industry.

All businesses choose a form of organization. Even a part-time business out of one’s own home is operating as an entity. Choosing the particular entity that best suits the business requires a thorough understanding of the nature of the business, relevant state and municipal law, federal income tax ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.