CHAPTER 41 Income Tax Fundamentals and Calculations

Lance Palmer, PhD, CPA, CFP®

University of Georgia

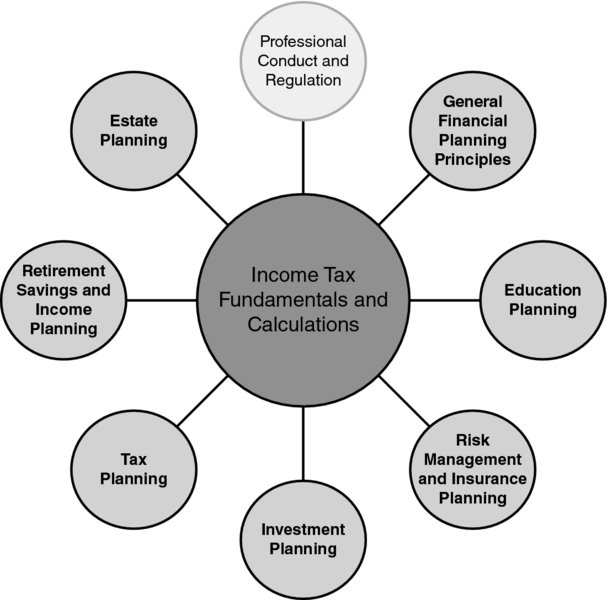

CONNECTIONS DIAGRAM

While the primary focus of this topic is on tax planning, concepts learned in this chapter apply directly to several other areas of financial planning. Many financial transactions, including purchasing insurance products, disposing of investment assets, and inheriting a qualified plan, affect the client’s income tax situation. A personal financial planner must understand how these various transactions affect the client’s current tax situation and be able to calculate and anticipate the change in tax liability. Most areas in financial planning, including retirement planning, cash flow management, education planning, risk management and insurance planning, investment planning, and estate planning, are affected by income tax issues.

INTRODUCTION

Form 1040 is the standard template for reporting and calculating individuals’ and married couples’ federal income and self-employment tax liabilities. While Form 1040 has gone through many revisions since its debut for the 1913 tax year, it has remained the primary reporting document required by the Internal Revenue Service (IRS) for individuals to report their tax related transactions. Obviously, many changes in the tax law, tax rates, and filing requirements have occurred since 1913. These ongoing changes necessitate ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.