CHAPTER 40 Fundamental Tax Law

Lance Palmer, PhD, CPA, CFP®

University of Georgia

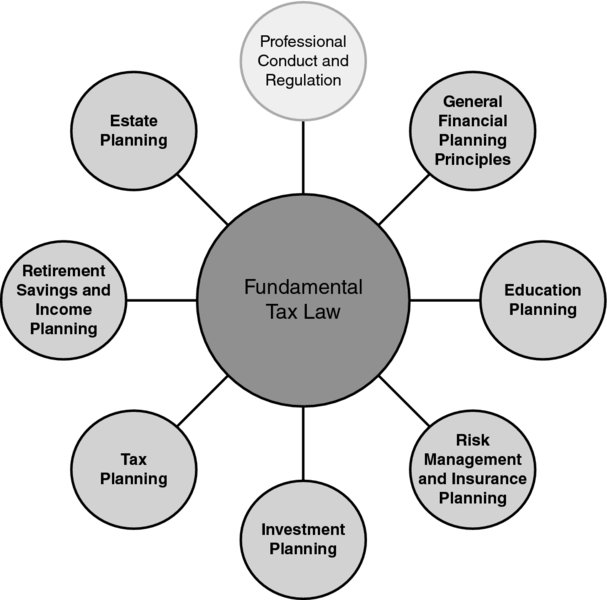

CONNECTION DIAGRAM

While the primary focus of this topic is on tax planning, the concepts in this chapter apply directly to several other areas of financial planning. Retirement planning is directly affected by fundamental principles of income taxation, particularly when considering contributions to, earnings within, and distributions from tax-advantaged retirement plans. Cash flow management and financing strategies may also be directly impacted due to the after-tax cost of certain financing options relative to other financing strategies. Income tax planning should also be incorporated into education planning, particularly what combination of education credits, deferred tax on earnings, and/or tax deductions on interest provide the greatest benefit to clients.

The passage and implementation of the Affordable Care Act (also known as Obamacare) has further intertwined income tax planning and risk management and insurance planning. Increased taxes, such as the Medicare surtax of 0.9 percent, have increased higher-income households’ tax burden while middle income households have received greater access to refundable health insurance premium tax credits, if certain conditions are met. Additionally, changing income tax laws regarding capital gains rates and net investment income taxes have a direct ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.