CHAPTER 36 Bond and Stock Valuation Concepts

Dave Yeske, DBA, CFP®

Golden Gate University

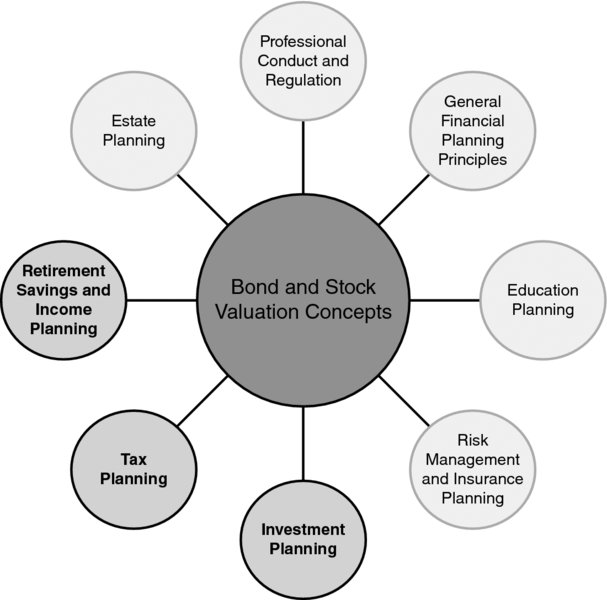

CONNECTIONS DIAGRAM

Factors that affect the valuation of stocks and bonds can have tax implications. For example, rising or falling interest rates can create premium and discount bonds, which have income tax implications (tax planning). Retirement planning depends on many assumptions related to capital market returns, which in turn depend on an understanding of how markets price bonds and stocks (retirement savings and income planning).

INTRODUCTION

While financial planners assume many different roles with respect to client investment decisions, ranging from generalized advice to actual implementation and portfolio management, a thorough understanding of security valuation models is nonetheless essential knowledge for all planners. Even when a financial planner is not engaged in individual security analysis, understanding the models used by other market participants provides insights into how markets work and allows the planner to provide better investment advice, including the kind of clear explanations that keep clients committed to a consistent course of action.

Stock and bond valuation techniques based on the concept of present value have been documented from the mid-nineteenth century, when actuarial techniques for valuing annuities were applied to stocks, a word that at the time ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.