CHAPTER 35 Asset Allocation and Portfolio Diversification

Dave Yeske, DBA, CFP®

Golden Gate University

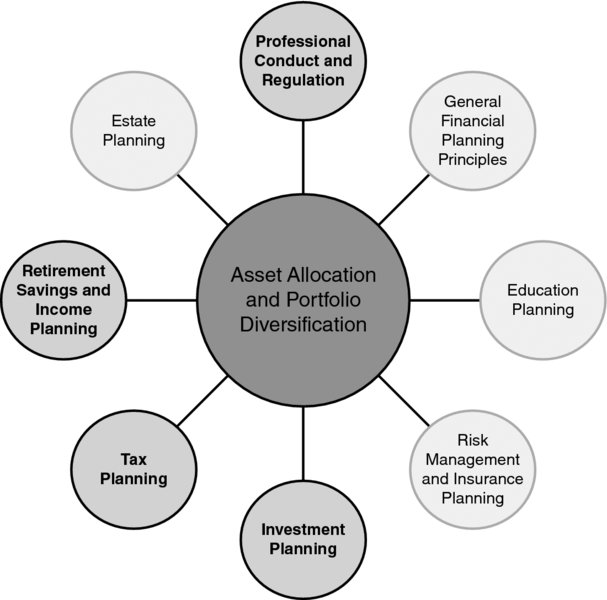

CONNECTIONS DIAGRAM

Asset allocation and portfolio diversification is a fundamental element of the investment process (investment planning). Various asset allocation and diversification strategies will have different income tax considerations that must be accounted for depending on the tax status of the investor and/or the type of account that holds the assets (tax planning). Different asset allocation and diversification strategies may be indicated when investing for retirement (retirement savings and income planning). The professional delivery of investment advice is regulated by state and federal agencies as well as self-regulatory organizations (professional conduct and regulation).

INTRODUCTION

When advising clients on strategies to meet their financial goals, financial planners are often called upon to make recommendations regarding the deployment of client savings in pursuit of an investment return consistent with planning assumptions. In giving such advice, financial planners must have a thorough understanding of the primary factors that influence a portfolio’s risk and return, most especially asset allocation and diversification. Asset allocation refers to the process of selecting broad investment categories (e.g., cash, bonds, large-cap stocks, small-cap stocks, ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.