CHAPTER 33 Quantitative Investment Concepts

Thomas Warschauer, PhD, CFP®

San Diego State University

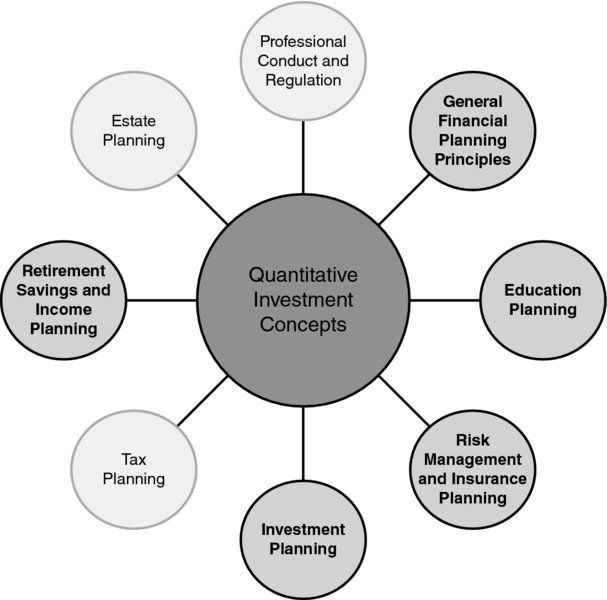

CONNECTIONS DIAGRAM

Almost all aspects of investment theory and practice have an element of quantitative analysis, and a basis in statistical methodology. Quantitative investment concepts are used throughout the investment considerations in retirement planning, with Chapter 53 devoted to “Types of Retirement Plans.” These statistical tools are commonly used in economic analysis (see Chapter 10). They are also sometimes related to time value computations (see Chapter 11). Statistical concepts, such as sensitivity analysis and Monte Carlo simulation, discussed in this chapter, are utilized by all goal achievement methods, including retirement needs analysis (see Chapter 50), education planning (see Chapters 15–19), and insurance needs analysis (see Chapter 28).

INTRODUCTION

Every competent financial planner should possess a comprehensive understanding of basic statistical methods. Nowhere in the profession is this more obvious than in the investments field. But as the connections diagram indicates, the use of these tools is more far-reaching than the investment area itself.

The reason for the pervasive nature of statistics, particularly in investments, but also elsewhere in planning, is the stochastic nature of the real world planners are forced to contend with. As no one has ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.