CHAPTER 32 Types of Investment Risk

Thomas Warschauer, PhD, CFP®

San Diego State University

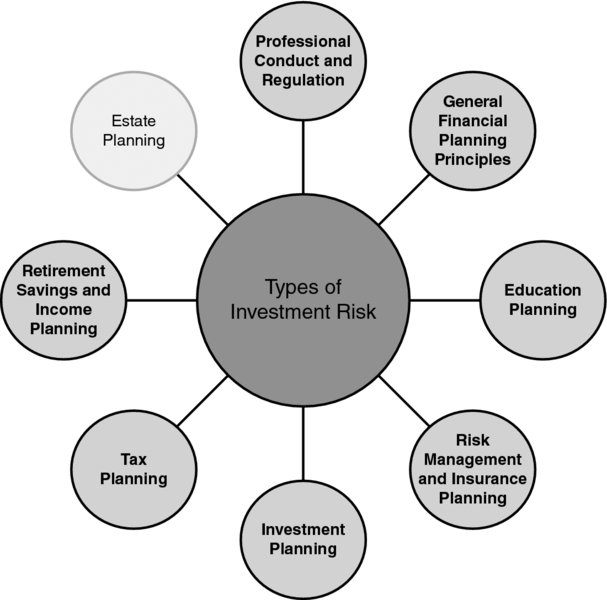

CONNECTIONS DIAGRAM

Although personal financial planners provide a multitude of services, one of the most common is matching investment selections to client goals and needs. Virtually every goal is funded by investments that take risk into account. Investment risk is a central factor that is directly reflected in education and retirement planning as well as other goals considered under “General Principles.” Investment risk is also associated with economic conditions, another “General Principle.” All decisions to accept, select, or resist investment risk are affected by the client’s psychological risk tolerance and their objective risk-taking abilities. Finally, there are likely more regulatory issues related to “Professional Conduct” in investment risk than most other elements of financial planning practice.

INTRODUCTION

Two common functions financial planners provide are: first, to help clients avoid investment risk they needn’t take and, second, to select the appropriate level of risk necessary to achieve client goals subject to their risk preferences. In order to accomplish these functions, planners need to understand each source of investment risk. That includes understanding what causes each type of risk, how it can be measured, and how it can be controlled. In addition to traditional ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.