CHAPTER 31 Characteristics, Uses, and Taxation of Investment Vehicles

Swarn Chatterjee, PhD

University of Georgia

Lance Palmer, PhD, CPA, CFP®

University of Georgia

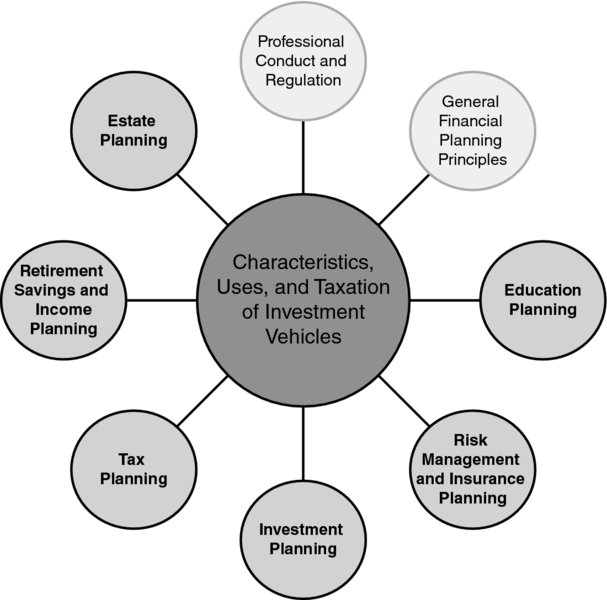

CONNECTIONS DIAGRAM

Investment is the vehicle used by a client to achieve mid- and long-term goals. Without investment of some sort, long-term goal achievement is difficult. Because of this fundamental role that investment plays in a client’s overall financial plan, this chapter is connected to several areas of financial planning, particularly relating to long-term and short-term goal achievement, risk management, and cash flow. Specific topic areas include investment planning, income tax planning, retirement planning, estate planning, and education planning.

INTRODUCTION

The financial markets are dynamic, volatile, and continually changing environments that present both opportunities and challenges to financial planners as they strive to manage their clients’ portfolios both effectively and efficiently. Therefore, the knowledge of various investment vehicles that are available, the applications of these vehicles in investment planning, and an understanding of the associated tax implications are essential for financial planning professionals as they endeavor to manage their clients’ portfolios by overcoming the existing challenges and taking advantage of the opportunities that are present in today’s securities ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.