CHAPTER 28 Insurance Needs Analysis

Thomas Warschauer, PhD, CFP®

San Diego State University

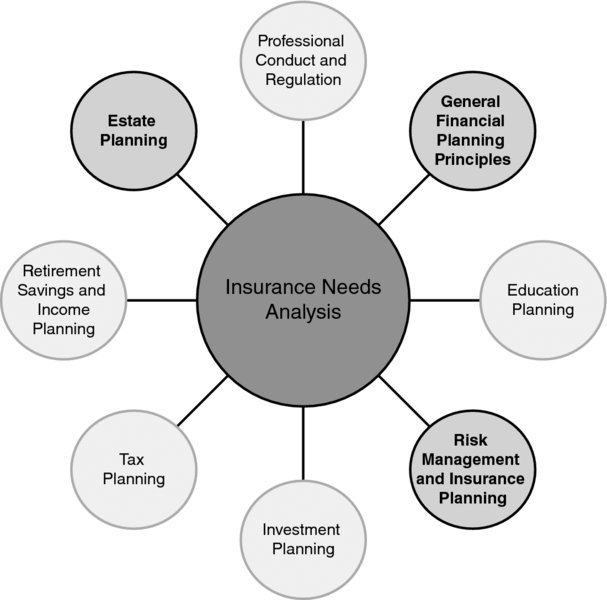

CONNECTIONS DIAGRAM

The evaluation of insurance needs interacts with various groups of financial planning topics. Every type of insurance product has a cost to the client, sometimes a substantial one. So, cash flow management is significantly affected by the purchase expense of insurance products. This is true to the extent that the selection of the features of insurance products is, in part, determined by their ability to fit within the client’s budget (see Chapter 8, Cash Flow Management). Life insurance needs are often selected on the basis of present value computations (see Chapter 11, Time Value of Money). The Insurance Needs Analysis topic interacts with all the other insurance chapters (see Chapters 20 to 30). Insurance needs interact with taxation from the point of view of the taxation of proceeds received either from a claim or from a return of capital from a savings-type insurance product. Finally, estate taxation and liquidity are often provided for by insurance products.

INTRODUCTION

Risk management is an essential element of any financial plan. The reason is simple: Other important financial goals, even if well-funded, may not be attained if an adverse-risk event is unprotected.

Insurance needs are complicated by their sometimes high cost. That is, nearly everyone would ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.