CHAPTER 27 Business Uses of Insurance

L. Ann Coulson, PhD, CFP®

Kansas State University

John Gilliam, PhD, CFP®

Texas Tech University

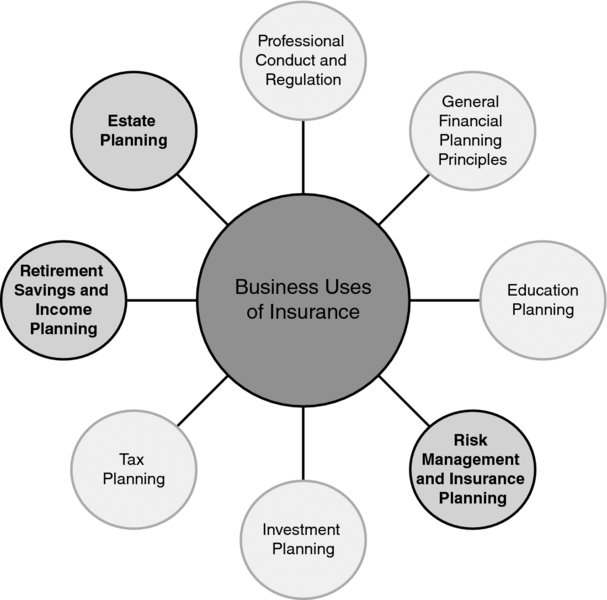

CONNECTIONS DIAGRAM

Insurance is protection. Business use of life insurance is a layer of protection that can provide for those left behind following the death of a business owner or a key employee. Business uses of life insurance relate to estate planning as the insurance proceeds may be used to buy the business from heirs and thus provide estate liquidity as well as retirement planning for key employees through the use of non-qualified deferred compensation.

INTRODUCTION

Ownership entails a variety of forms across the 5.75 million small businesses in the United States, and for each type, the death of an owner creates unique concerns.1 For example, sole proprietors face particular challenges when no family members are interested in taking over the business. In the absence of planning, the business may be sold or even forced to liquidate, which may not provide desirable results for the survivors of the deceased. The death of a sole corporate owner presents similar challenges, even though the corporation does not dissolve. Understanding the unique planning considerations for the business owners and key executives who operate these organizations is paramount in comprehensive financial planning. This chapter focuses on transferring business interests ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.