CHAPTER 24 Long-Term Care Insurance

Andrew Head, MA, CFP®

Western Kentucky University

Sharon A. Burns, PhD, CPA (Inactive)

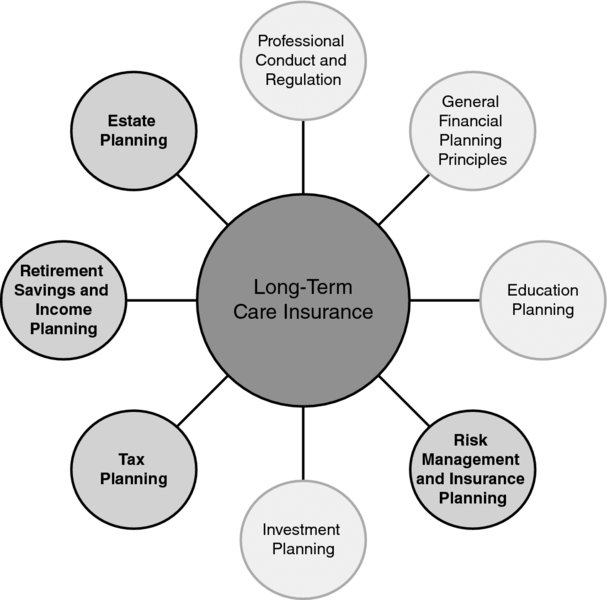

CONNECTIONS DIAGRAM

Long-term care (LTC) is for the aged or infirm. This is exactly why it should be included in discussions of income tax and retirement planning. The cost of long-term care may be prohibitive, thus reducing the financial resources available for other living expenses during retirement or during periods of extensive medical care. Because a portion of long-term care is considered to be for medical treatments, the Internal Revenue Code allows those who purchase LTC insurance to deduct a portion of the premiums as a medical expense on Schedule A of their tax returns. Financial planners need to be aware of the effect that long-term care expenses may have on retirement income and assets, as well as the eventual estate legacy.

INTRODUCTION

According to the U.S. Department of Health and Human Services, at least 70 percent of people over age 65 will require long-term care at some point in their lives. In 2012, the average cost of stay in a nursing home ranged from $131 per day in Texas to $687 per day in Alaska, while the cost of assisted living facilities ranged from $2,355 per month in Arkansas to $5,933 in Washington, D.C. In contrast, the average cost of home care ranges from $13 per hour in Shreveport, Louisiana, to $32 per hour in Rochester, ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.