CHAPTER 20 Principles of Risk and Insurance

Dave Yeske, DBA, CFP®

Golden Gate University

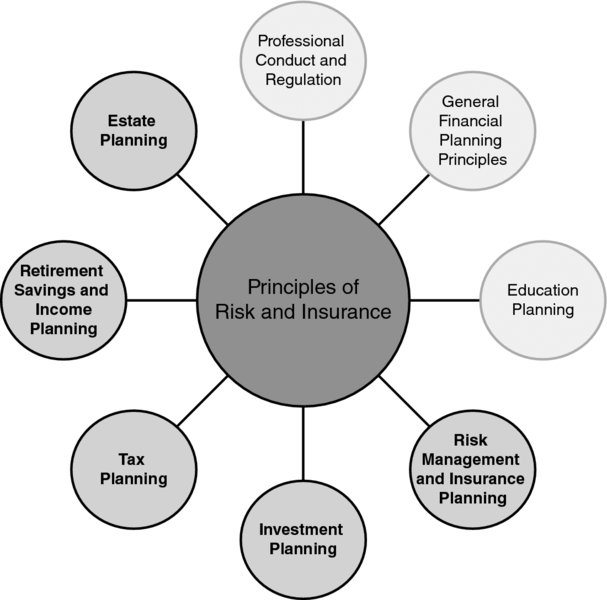

CONNECTIONS DIAGRAM

Many insurance products, including life insurance and annuities, are used in retirement planning and the investment of retirement plan assets. Life insurance plays a large role in estate planning, including as a means of providing estate liquidity and facilitating equalization among beneficiaries when there are assets (such as a closely held business) that may be hard to equitably divide. As with all aspects of financial planning, the ability to effectively communicate with clients and allied professionals is essential to uncover relevant information and communicate recommendations.

INTRODUCTION

Financial planners use many assumptions that involve uncertainty when analyzing client goals and developing strategies to achieve them. For example, a planner might assume that a 40-year-old wage earner will continue to save 10 percent of her earnings until age 65 in pursuit of a comfortable retirement. However, there exists some probability that job loss, disability, or premature death will invalidate this assumption, potentially derailing the financial plan. Thus, it is extremely important that the financial planner be able to identify relevant risks and recommend ways to mitigate or eliminate them, thereby maximizing the probability that clients will achieve their financial ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.