CHAPTER 18 Gift and Income Tax Strategies (Education)

Martie Gillen, PhD

University of Florida

Michael Gutter, PhD

University of Florida

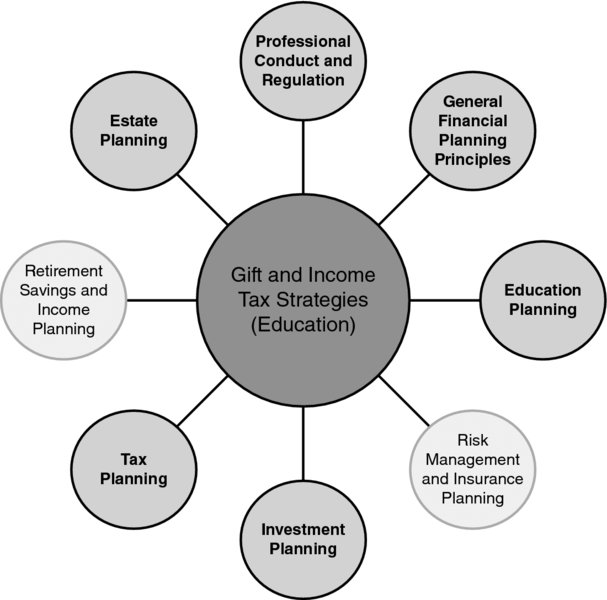

CONNECTIONS DIAGRAM

Education represents a substantial financial commitment. A client can give an unlimited amount for tuition on behalf of any individual tax-free. However, the client must pay the amount directly to the educational provider. In addition, the client could pay college tuition bills on behalf of their child or grandchild and still be allowed to give that child additional tax-free annual gifts up to the exclusion amount. Other education savings options that allow tax-free gifts specific to post-secondary education such as a 529 College Savings Plan are discussed in the Education Savings Vehicles chapter. The use of tax credits and deductions are other income tax strategies relevant to education planning. The financial planner must adhere to ethical standards of professional conduct and fiduciary responsibility.

INTRODUCTION

Gifting may be an important part of a family’s education funding plan, as well as efficient intergenerational wealth transfers. If tuition is paid directly to the provider, then the gift is not included in the client’s annual gift exclusion amount. For example, if a client pays $23,000 for their grandchild’s tuition directly to the school, they can still gift up to the annual exclusion amount ($14,000 in ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.