CHAPTER 16 Education Savings Vehicles

Michael Gutter, PhD

University of Florida

Martie Gillen, PhD

University of Florida

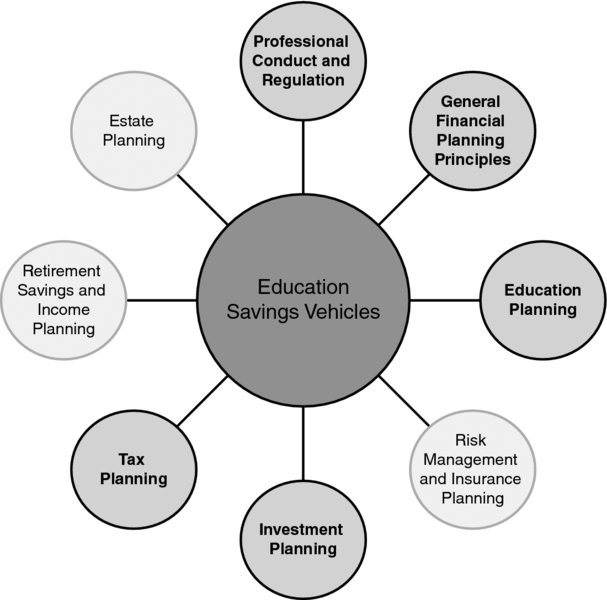

CONNECTIONS DIAGRAM

Planning for education relates to various financial planning issues that must be addressed for clients. This includes goal setting, cash flow management for funding savings and investment vehicles, tax considerations, estate planning, and certainly professional conduct and regulation in conducting the analysis. Clients have several methods for funding education. Assuming the child or children will not receive scholarships or other resources, families must decide how best to fund the cost of education. Some possibilities, in addition to saving strategies, include: gifts from a relative, paying out of cash flows, financing through student loans, or leaving the burden to the children. There are a number of options for saving for educational goals. These different options may be confusing for clients and result in inefficient plans. As part of the financial planning process, recognizing and evaluating savings strategies is of utmost importance in helping clients set and achieve education goals. A financial planner should stress the importance of savings strategies, including selecting the account, which assets to hold, and how to build the required capital into the cash flow management plan.

INTRODUCTION

A financial planner must be able to ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.