Chapter 13

Execution Strategies

Trading strategies that were discussed in former chapters are derived for producing positive returns in round-trip trades. In other words, these strategies offer signals on what and when to buy and sell. Sometimes, the term opportunistic algorithm is used for denoting them (Johnson 2010). Another problem that traders face is reducing the losses associated with the trading process. Some of these losses, such as the brokerage fees, commissions, and taxes are fixed. Others depend on the order placement strategy and therefore may be minimized.

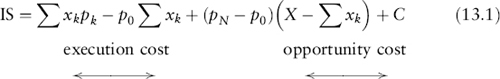

Perold (1988) introduced the notion of implementation shortfall (IS) as a measure of the total transaction costs. IS represents the difference between the actual portfolio return and the paper estimate of this return at the beginning of trading.1 If trading of an order with size X started at price p0 (arrival price) and ended at price pN, and the order was split into N child orders of size xk that were filled at price pk, then

In (13.1), C is the fixed cost. Note that not all child orders may be executed during the trading day. For example, submission of child orders may be conditioned on specific price behavior. The unfilled amount, X − Σxk, determines an opportunity cost.

A new field, algorithmic trading, focuses on making decisions where and how to trade. Note that the notion of algorithmic trading is sometimes ...

Get Financial Markets and Trading: An Introduction to Market Microstructure and Trading Strategies now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.