CHAPTER TWO

The Path to Corruption

FRAUDULENT FINANCIAL REPORTING can occur in almost any business. The risk is inherent in the pressure for performance. Where that pressure gets out of hand, objectivity can be lost and financial fraud can follow.

A fair reaction by investors and other readers of financial information would be: Well, that's just great. But what are the circumstances that put a company on the path to corruption? And what are the telltale signs? Ideally, we could gain an understanding of the forces that can cause companies to go astray so that users of financial information—shareholders, lenders, creditors, underwriters, insurers, venture capitalists, investment banks, and others—can avoid them. It is to this subject that we now turn.

LOOKING AT THE NUMBERS

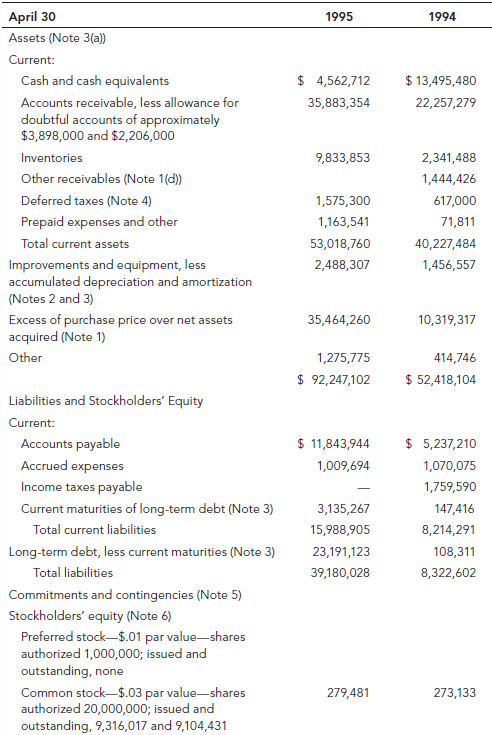

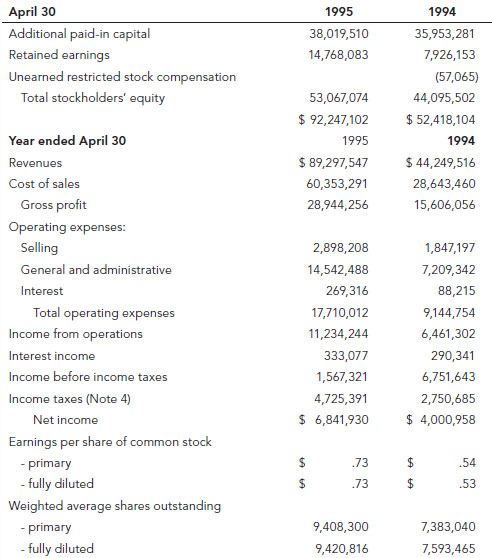

For fun, let's start with some financial statements. Set forth in Exhibit 2.1 are the balance sheet and the income statement of a public company in the drug distribution business. Take a look at them. The question when you are through will be: Do you see any indication of an accounting irregularity? (Here's a clue: At least one of the numbers is fraudulent.)

EXHIBIT 2.1 Sample Balance Sheet and Income Statement

Did you find it? Don't feel too bad. The auditors didn't either.

The company is (actually, was) a New ...

Get Financial Fraud Prevention and Detection: Governance and Effective Practices now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.