CHAPTER 9

REPORTING AND ANALYZING LONG-LIVED ASSETS

LEARNING OBJECTIVES

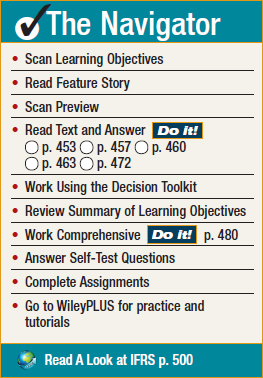

After studying this chapter, you should be able to:

- Describe how the historical cost principle applies to plant assets.

- Explain the concept of depreciation.

- Compute periodic depreciation using the straight-line method, and contrast its expense pattern with those of other methods.

- Describe the procedure for revising periodic depreciation.

- Explain how to account for the disposal of plant assets.

- Describe methods for evaluating the use of plant assets.

- Identify the basic issues related to reporting intangible assets.

- Indicate how long-lived assets are reported in the financial statements.

![]()

Feature Story

A TALE OF TWO AIRLINES

So, you're interested in starting a new business. Have you thought about the airline industry? Is your only experience with airlines as a passenger? Don't let that stop you. Today, the most profitable airlines in the industry are not well-known majors like American Airlines and United. In fact, most giant, older airlines are either bankrupt or on the verge of bankruptcy. In a recent year, ...

Get Financial Accounting: Tools for Business Decision Making, 7th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.