INTRAPERIOD TAX ALLOCATION

Federal income taxes, which do not include state and local taxes, are disclosed in two different ways on the income statement. The first income tax disclosure immediately follows net income from continuing operations (before tax). It represents the tax expense resulting from all taxable revenues and deductible expenses except for those listed below it on the income statement.6

The dollar amounts associated with the remaining items (disposal of business segments, extraordinary items, and changes in accounting principles) are all disclosed net of tax. Such presentation means that each of these revenue and expense items is disclosed on the income statement after the related income tax effect has been removed. The practice of including the income tax effect of a particular transaction with the transaction itself on the income statement is known as intraperiod tax allocation. It enables users to assess the total financial impact of these special transactions as well as the tax benefit or cost associated with them.

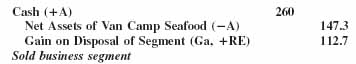

For example, when Ralston Purina Company sold its Van Camp Seafood division for $260 million, the book value of Van Camp was $147.3 million, and a gain of $112.7 million was recognized on the transaction with the following journal entry (dollars in millions):

The gain, however, was included in Ralston Purina's taxable income and increased the company's ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.