REVIEW PROBLEM

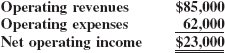

The operating revenues and expenses of Panawin Enterprises for 2012 follow, along with descriptions of and entries for several additional transactions. Assume that income taxes on income from continuing operations are $7,000, the effective income tax rate on other items is 34 percent, the balance in retained earnings as of December 31, 2011, is $106,000, and dividends declared during 2012 total $16,000.

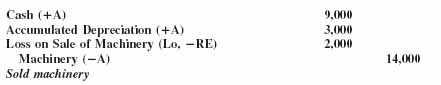

1. Machinery with an original cost of $14,000 and a book value of $11,000 was sold for $9,000. The transaction was considered unusual but not infrequent.

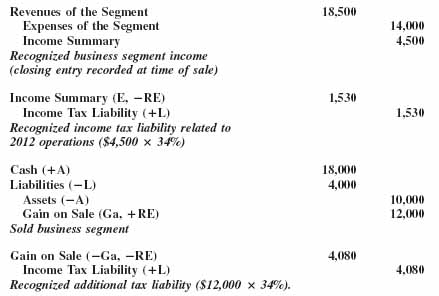

2. A separate line of business (segment) was sold on March 14, 2012, for $18,000 cash. The book values of the assets and liabilities of the segment as of the date of the sale were $10,000 and $4,000, respectively. The business segment recognized revenues of $18,500 and expenses of $14,000 from January 1, 2012, to March 14, 2012.

3. On September 12, 2012, Panawin retired, before maturity, outstanding bonds with a face value of $120,000, for a cash payment of $130,000. The bonds were originally issued at a premium, and the unamortized premium as of the date of retirement was $3,000. The loss on the retirement is considered ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.