FINANCIAL INSTRUMENTS, FAIR MARKET VALUES, AND OFF-BALANCE SHEET RISKS

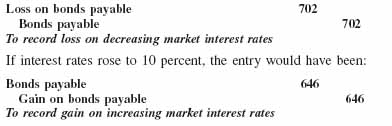

Under the fair market value option, according to both U.S. GAAP and IFRS, companies can account for their long-term debts as described above (effective interest method, sometimes called amortized cost) or at fair market value. If the fair market value option is exercised, the amount of the debt is adjusted to fair market value, and the associated gain or loss appears on the income statement. In the illustration above with Olsen Foods, for example, when interest rates fell by 2 percent under the fair market value option, Olsen would book the following entry.

While this option is available, most companies do not exercise it. Rather, they choose to disclose the fair market value of the debt in the footnotes. The following excerpt was taken from the 2008 annual report of Federal Express. The reader can ascertain from the footnote that market interest rates for Federal Express's long-term debt were below the debt's effective interest rates.

We had outstanding long-term debt with an estimated fair market value of $2.4 billion at May 31, 2009 and $1.9 billion at 2008 (balance sheet values were $2.6 billion and $2.0 billion, respectively). The underlying fair market values were estimated based on quoted market prices or the current rates offered for debt with similar terms and maturities.

Johnson & Johnson reported ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.