BASIC DEFINITIONS AND DIFFERENT CONTRACTUAL FORMS

Long-term obligations normally represent contractual agreements to make cash payments over a period of time. In addition to other terms, these contracts specify the period of time over which the payments are to be made as well as the dollar amount of each payment. Different contracts express these terms in different ways, giving rise to long-term obligations-and their associated cash flows-that take various forms.

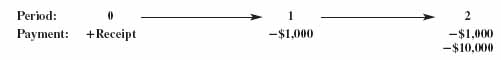

Some contracts, called interest-bearing obligations, require periodic (annual or semiannual) cash payments (called interest) that are determined as a percentage of the face, principal, or maturity value, which must be paid at the end of the contract period. For example, a company may enter into an exchange in which it receives some benefit (e.g., cash, asset, or service) and, in return, promises to pay $1,000 per year for two years and $10,000 at the end of the second year. Such an obligation would have a life of two years, a stated interest rate of 10 percent ($1,000/$10,000), and a maturity, principal, or face value of $10,000. The cash flows associated with this contract are illustrated as follows:

Non-interest-bearing obligations, on the other hand, require no periodic payments, but only a single cash payment at the end of the contract period. For example, a company may enter into another exchange in which it receives ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.