BRIEF EXERCISES

REAL DATA

BE11-1

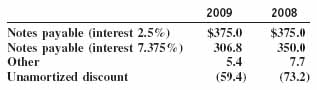

Inferring debt transactions

The following table was taken from the 2009 annual report of RadioShack. Long-term debt (in millions)

a. Briefly explain the transactions entered into by RadioShack during 2009. Which financial statements were affected?

b. Approximately how much interest expense was recognized in 2009 on the 2.5 percent notes?

c. Assume that RadioShack paid $300 million to retire the 7.375 percent notes in 2009. How much gain or loss would RadioShack have recognized on the transaction? Where in the financial statements would it be found?

REAL DATA

BE11-2

Bond issuance

In October 1997, Hewlett-Packard issued zero coupon (stated interest rate = zero) bonds with a face value of $1.8 billion, due in 2017, for proceeds of $968 million.

a. What is the life of these bonds?

b. What is the stated interest rate on these bonds?

c. Estimate the effective rate of interest on these bonds.

d. How many bonds did HP issue?

REAL DATA

BE11-3

Operating and capital leases

During fiscal 2007, the SUPERVALU grocery chain paid approximately $569 million on its lease contracts—$168 million on capital leases and $401 million on operating leases.

a. How did the operating lease payments affect the income statement, balance sheet, and statement of cash flows?

b. How did the capital lease payments affect the income statement, balance sheet, and statement of cash flows? ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.